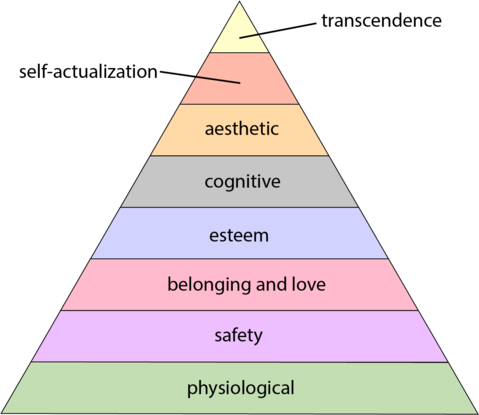

The Maslow Pyramid

IN 1943 Abraham Maslow published a theory that has come to be known as the hierarchy of needs. The theory breaks down what he saw as the fundamental motivations of human nature. The pyramid below has become quite famous.

Hierarchy of Needs

The base of the pyramid is identified as the absolute bare necessities to survive. Food. Water. Basic shelter from the elements.

As the needs move up through the pyramid the needs become less and less necessary to survive. Safety, for example, involves a more sophisticated shelter that may offer some protection from predators, if we are thinking evolutionarily. Once we get into belonging and love and further, the needs become increasingly “nice-to-haves” rather than bare essentials to continue breathing.

Belonging and love, while perhaps necessary to live a fulfilling and thriving life, are not strictly necessary to survive. However, belonging and love do give an added survival benefit of being part of a pack rather than facing the harsh world alone.

The United States defines “poverty” as an individual who earns less than $13,590 annually. Which is objectively way too low since many welfare benefits remain intact up to 400% of that number ($54,360). Even those below the $13,500 mark, if you live in the United States, the bottom two categories: physiological, and safety, are likely being met. Just existing in the United States (and most 1st world countries) gives you basically an automatic pass for two steps of the pyramid.

Once we get to step 5 and above, the needs start to require a bit of effort for most people. However, it is my belief that financial independence is the cheat code that can unlock the rest of the pyramid. I’m not talking about the billionaire level of wealth, where you can literally do anything you want in this world including paying someone to build you a rocket and take you to outer space for the hell of it. I’m talking about the level of wealth most people truly want, even if it’s subconsciously. The level of wealth that allows them to do what they want, but still requires them to put some thought into what it is they truly desire in this world.

The current FI literature says you need 25x your current annual expenses to achieve FI at a 4% withdrawal rate of your assets. That 4% comes from the Trinity Study. About $2-5 Million is a sufficient amount for most people to leave their primary job and live exactly as they are without ever earning another dime of income. However, it is reasonable to suspect that a large portion of people have aspirations to live differently post-work than when work is optional. Some people may do the math and find they need $10 Million to achieve their dreams, and that is OK! Just plan for it!

Here at the Minerva Household we have accounted for that lifestyle creep in our FI planning by anticipating wanting to spend a bit more each year than we do now during accumulation. Since we are a bit more conservative, we are going for the 3% withdrawal rate (33x annual expenses). Our FI plan is enough that I never have to work a day-job again if I don’t want to, but I still (sadly) won’t be able to buy a ticket to space. I won’t be able to buy 4 houses, or a Lamborghini. I will be able to pursue adventures I’ve already dreamt up and accounted for. I will be able to hopefully achieve what Maslow called self-actualization, Buddha called Nirvana, and what I call Minerva.